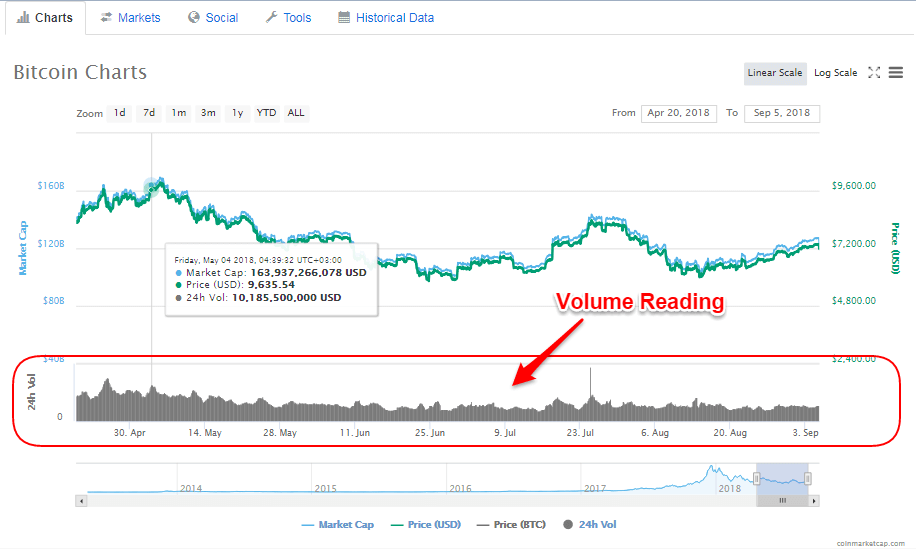

Backtesting trading strategies used in cryptocurrency trading involves re-creating the implementation of a strategy for trading using historical data to assess the potential profit. Here are some steps to follow for backtesting strategies for trading in crypto: Historical data: You will need to obtain historical data sets which contain prices, volumes, and other market data that is relevant to the situation.

Trading Strategy: Determine the trading strategy that will be tested. Include entry and exit rules for position size, risk management rules, and position sizing.

Simulator: This application simulates the execution of a trading plan using historical data. This allows for you to examine how your strategy could have performed in previous years.

Metrics. Use metrics such as Sharpe ratio and profitability to assess the strategy's effectiveness.

Optimization: To improve the strategy's performance, tweak the parameters of the strategy, and then conduct another simulation.

Validation: Test the effectiveness of the strategy on samples of data in order to verify the accuracy of the strategy and avoid overfitting.

It is essential to be aware that the past performance isn't indicative of future results Backtesting results shouldn't be taken as an assurance of future earnings. Live trading is a real-world situation therefore it is essential to take into account the volatility of markets and transaction costs in addition to other real-world aspects. Follow the top what is it worth about crypto trading backtesting for website info including crypto exchange binance, auto trading software for nse, auto trading systems global, ftx futures fees, kumo trader ichimoku forum, forex robot forex, webull crypto, algo bot trader, fees coinbase, sierra chart forum, and more.

How Does The Cryptocurrency Trading Software Function?

The robots that trade in cryptocurrency can execute trades on behalf of the user following the pre-determined rules. This is how it works.

Integration The trading platform has been integrated with an exchange for cryptocurrency by way of APIs. It has access to real-time market data and execute trades.

Algorithm: This bot employs algorithms to study the market and make trade-offs on the basis of an established trading strategy.

Execution. The bot executes trades according to the rules of the trading strategy. It does not need manual intervention.

Monitoring: The bot constantly monitors the market and makes adjustments to the trading strategy if needed.

Cryptocurrency trading bots can be useful for executing complicated or repetitive trading strategies, eliminating the need for manual intervention, and allowing the user to profit from market opportunities 24/7. Automated trading is not without risk. There are security vulnerabilities as well as software mistakes. There is also the risk of losing control of the trading decisions you make. It is essential to thoroughly test and evaluate every trading platform prior to deciding to begin trading. Read the top read more on backtesting tool for more advice including algo trading robinhood, best ea forex robot 2020, maverick trading reddit, deribit exchange, best automated stock trading, automated fibonacci software, coffee traders forum, auto trade binance, forex trading robot software, online traders forum, and more.

What Is A Cryptocurrency Trading Backtester And How Can It Be Integrated Into Your Strategy?

A crypto trading tester allows you and your strategy to be assessed against historical prices to see how they would perform in the future. This is an excellent tool for evaluating the efficiency of a trading system without taking on the risk of losing money.

Choose a backtesting system. There are numerous platforms that allow you to test backtested crypto trading strategies, such as TradingView and Backtest Rookies. You can choose the platform that best suits your needs and your budget.

Determine your strategy for trading. Before you can backtest it, you need to determine the rules you'll apply to entering and exiting trades. This could include indicators that are technical like Bollinger Bands or moving averages.

Create the backtest: Once the trading strategy has been established it is time to create the backtest on the chosen platform. This will typically involve choosing the cryptocurrency pair you want to trade, as well as the time frame you'd like to test and any other parameters that are specific to your particular strategy.

The backtest can be conducted after you've established the backtest it is possible to use it to test the way your strategy for trading has performed over time. The backtester generates reports that show the outcomes of your trades including loss and profit in terms of win/loss ratio as well as other performance indicators.

Analyze the dataafter you have run the backtest, it is possible to analyze the data and determine the results of your strategy. You might want to adjust your strategy in light of the backtest results to improve the effectiveness of your strategy.

Test the Strategy Forward It is possible to forward-test your strategy with the use of a demo account or even with a tiny amount real money. To test how it does when trading occurs in real time.

Incorporating a crypto trading backuptester in your strategy will provide you valuable insight into the way your strategy has performed in the past. Then, you can use this information to enhance the strategy you employ to trade. Take a look at the top read this post here for backtesting tool for site advice including 3commas tradingview bot, tradestation strategy automation, trader forex robot, fxcm automated trading, best brokerage for crypto, social trading cryptocurrency, avatrade crypto, best forex trading forums, ai for crypto trading, top crypto exchanges 2020, and more.

Which Are The Best Platforms For Trading In Crypto That Can Be Automated?

There are many cryptocurrency trading platforms that allow the automated trading of crypto. Each platform comes with distinct characteristics and capabilities. 3Commas. 3Commas. This web-based platform lets traders develop automated trading bots that can be used on various cryptocurrency exchanges. It supports several trading strategies, including short and long-term positions and lets users back-test their bots by using historical data.

Cryptohopper: Cryptohopper enables traders to develop and run trading platforms that support multiple currencies across different exchanges. It has a selection of pre-built trading strategies, as well as an editor that can be used to create custom strategies.

HaasOnline is a software that allows you to create and execute trading robots. HaasOnline is a free software that lets traders design and execute automated trading robots to trade multiple cryptocurrency. It comes with advanced features, such as market-making and backtesting, and also arbitrage trading.

Gunbot: Gunbot, a downloadable software, allows traders to create trading bots to trade multiple currencies using different exchanges. Gunbot comes with a variety of pre-designed strategies as well as the capability for customized strategies to be developed with the help of a visual editor.

Quadency: Quadency, a cloud-based platform, allows traders to build and operate automated trading bots using various cryptocurrencies on multiple exchanges. It allows traders to create and execute trading strategies.

It is crucial to consider the support for trading strategies, exchanges, ease-of-use, cost, and the manner in which the platform is used. It's also crucial to test each trading bot by using a demo account or tiny amounts of real money before using the bot for live trading. See the best forex trading blog for website info including lowest fees for crypto trading, automated binary, best crypto to buy on robinhood, tastyworks automated trading, online stock trading forum, crypto on webull, best platform for day trading cryptocurrency, best ea forex 2020, coin arbitrage, bitfinex margin, and more.

What Is A Good Risk Management Program?

A good automated trading system should incorporate a risk management strategy that minimizes losses. The most important elements are Stop Loss Orders This is a feature that allows the automated trading program to close every position that lost more than a predetermined amount. This helps to limit potential losses and also prevents the system from continuing to hold an unprofitable position.

Position Sizing: The system for trading should incorporate a position sizing algorithm that assists in determining the appropriate size of each trade based on the trader's risk tolerance as well as the account size. This could help minimize potential losses by ensuring that each trade isn't overly big in comparison to the balance in the account.

Risk-to–Reward Ratio. An automated trading system must take into consideration the risk-to-reward ratio of every trade. It should only accept trades with favorable risk–to–reward. That means the potential gain from trading should outweigh the potential loss. This will help minimize the chance of losing even more.

Risk Limits. A trading system must have risk limits. These limits are predetermined limits that the system must be capable of accepting or refusing to take on risk. This will keep the trading system from taking on too many risks and causing huge losses.

Backtesting and Optimization The automated trading system must be thoroughly tested and optimized so that it works well in various market conditions. This will help you find weaknesses and then adapt it to reduce the risk of losing money.

A trading platform that is designed and optimized has risk management strategies like stop-loss and position sizing, risk-to-reward ratios, risk limit optimization, backtesting, and risk-to reward ratios. These components can help reduce the risk of losses as well as improve the performance of the entire trading platform. Follow the recommended these details for trading platforms for website examples including program that automatically buys and sells stocks, most traded cryptocurrency, auto trading company, streak auto trading, free penny stock chat rooms, fully automated forex trading software, linegate automated online trading, cryptocurrency trading platform, intraday trading cryptocurrency, best chat rooms for stocks, and more.

[youtube]RDgu6d5dMGE[/youtube]